Lem Verify

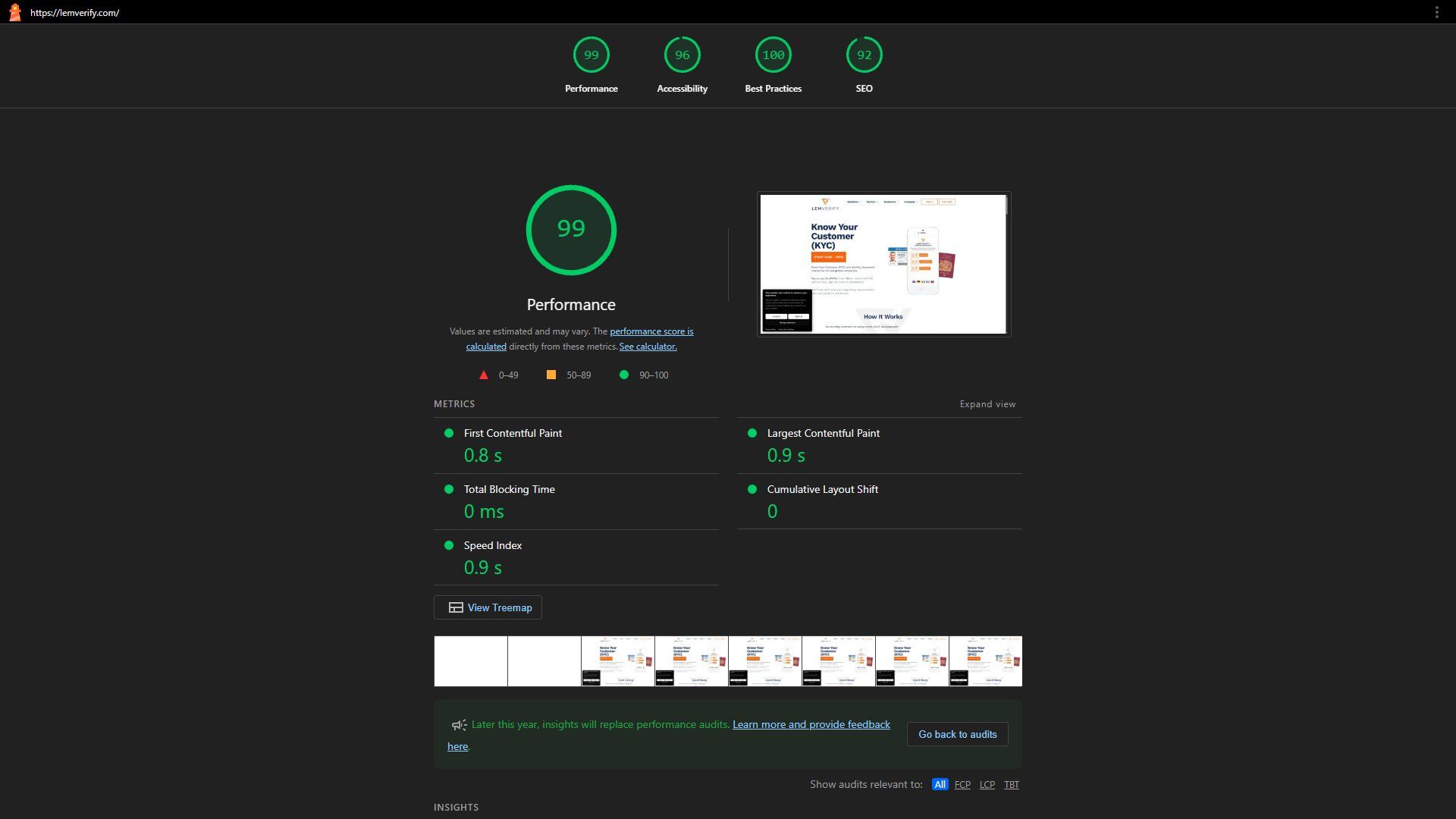

High-performance KYC platform achieving 98+ Lighthouse scores with an increase in sign-ups, featuring streamlined onboarding and regulatory compliance with 50% faster load times.

Key Achievements

High-Performance KYC Platform: Delivered best-in-class KYC marketing and onboarding platform with Lighthouse scores consistently above 98 for both performance and accessibility.

Regulatory Compliance Excellence: Successfully created platform that conveys complex KYC compliance requirements in clear, trustworthy, and engaging manner.

Dramatic Performance Gains: Achieved over 50% reduction in average page load times, leading to measurable decrease in bounce rates and 20% increase in user retention.

Enhanced User Conversion: Streamlined user journey resulting in 35% increase in successful sign-ups and significant uplift in pay-as-you-go offering conversions.

Agile Content Management: Implemented component-driven architecture enabling client to update content and launch informational pages without developer intervention.

The Challenge

LEM Verify, operating in the highly regulated financial compliance sector, faced critical challenges requiring a modern web solution:

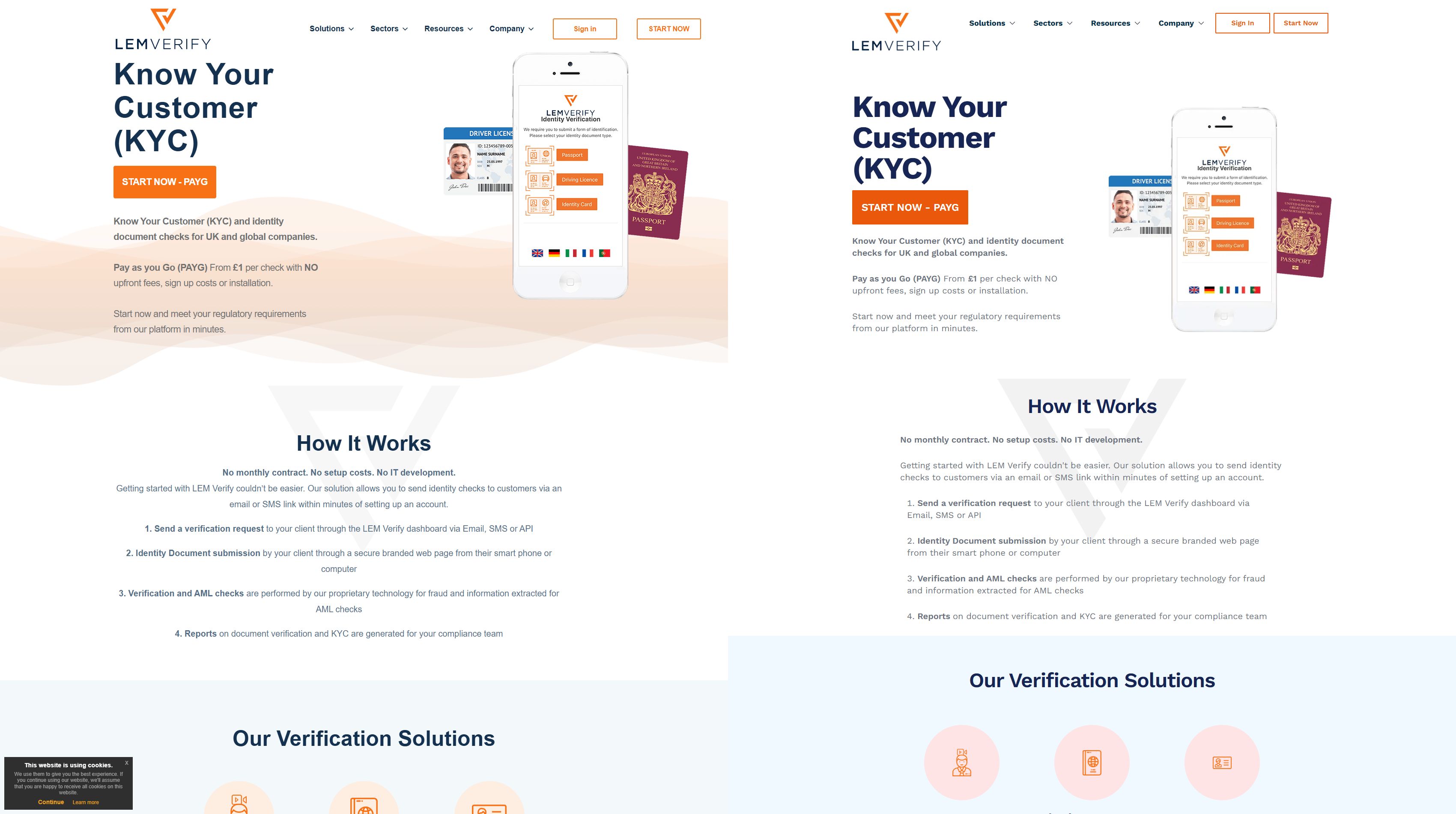

- Complex Regulatory Communication: Difficulty conveying KYC compliance intricacies in clear, trustworthy manner that instills confidence in potential clients

- Performance and SEO Limitations: Slow load times and suboptimal technical SEO leading to diminished organic reach and higher bounce rates in credibility-sensitive market

- User Activation Barriers: Convoluted user journey with slow interfaces and technical jargon increasing friction and negatively impacting conversion rates

- Scalability and Maintainability Issues: Difficult-to-extend stack requiring developer intervention for content changes and brittle design system

- Trust and Credibility Concerns: Digital presence failing to project authority and security consciousness expected in financial compliance sector

My Approach

I implemented a comprehensive development strategy focused on:

- Regulatory-First Design: Prioritizing clear communication of complex compliance requirements while maintaining trust and authority

- Performance-Optimized Architecture: Leveraging Astro’s island architecture for maximum speed and SEO performance in competitive SaaS landscape

- User-Centric Onboarding: Streamlining user journey to minimize friction and maximize conversion for rapid, code-free KYC activation

- Comprehensive Compliance Integration: Building GDPR compliance and accessibility into core platform architecture

- Scalable Content Strategy: Implementing flexible content management system for agile response to regulatory changes

My Solution

Technology Stack Implementation

Astro Framework: Selected for island architecture and partial hydration model, delivering pages with virtually no JavaScript by default while maintaining rich interactivity where needed.

Tailwind CSS: Implemented utility-first approach for rapid prototyping and highly consistent design language that inspires trust and authority in compliance sector.

TypeScript Integration: Utilized static typing for additional confidence and maintainability in sensitive KYC workflows, catching errors at compile-time and ensuring deployment reliability.

SEO & Accessibility Suite: Integrated @astrojs/rss and @astrojs/sitemap for automated structured metadata, RSS feeds, and sitemaps to improve technical SEO and discoverability.

GDPR Compliance: Implemented vanilla-cookieconsent for lightweight cookie consent management, ensuring regulatory alignment and reinforcing commitment to responsible data handling.

Key Features Delivered

- MDX Content System: Enabled rich, dynamic content combining Markdown simplicity with React components for complex regulatory topics and user engagement

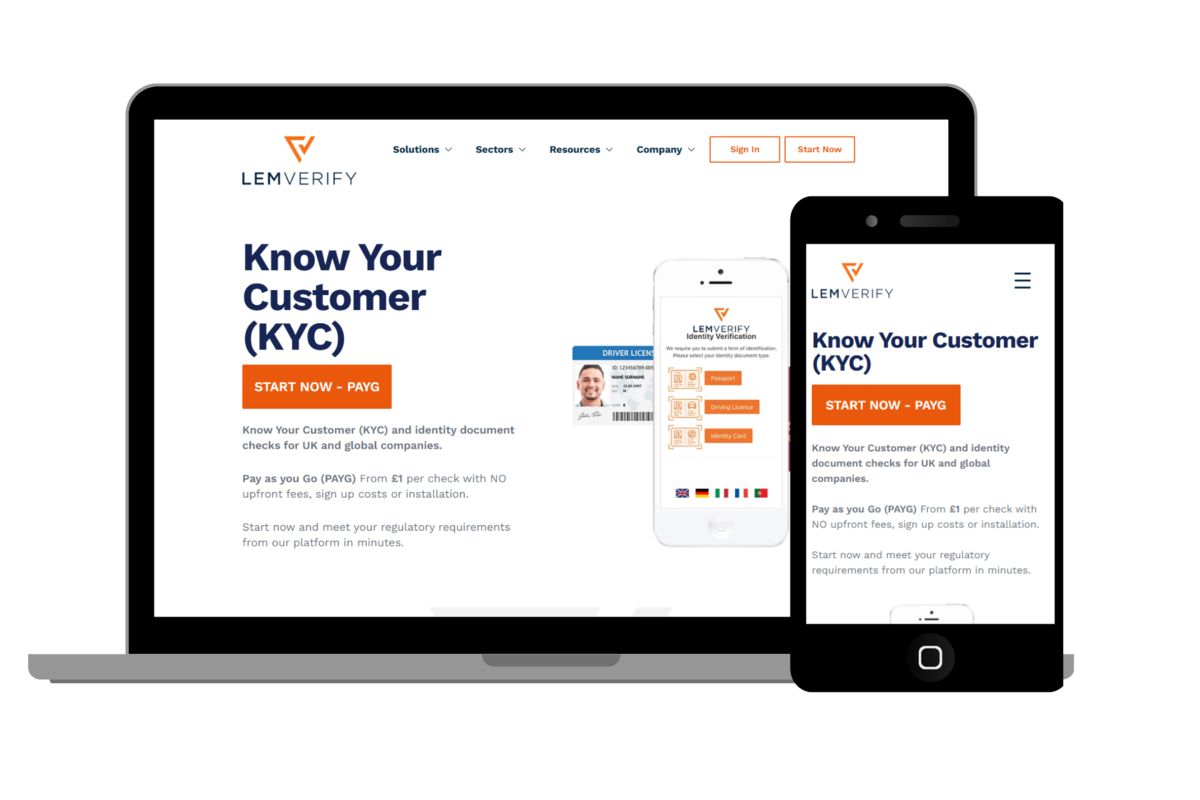

- Responsive Design System: Created custom, responsive design ensuring pixel-perfect layouts across all devices while maintaining accessibility and WCAG compliance

- Performance Optimization: Achieved dramatic speed improvements through strategic asset loading and minimal JavaScript shipping

- Component-Driven Architecture: Established modular codebase enabling rapid content updates and new feature development

- Trust-Building UI Elements: Designed interfaces that project authority and security consciousness expected in financial compliance sector

Measurable Results

Performance Achievements:

- Consistently achieved Lighthouse scores above 98 for both performance and accessibility

- Over 50% reduction in average page load times compared to previous platform

- Dramatically improved Core Web Vitals scores across all key metrics

- Measurable decrease in bounce rates due to improved load times

User Experience Impact:

- 20% increase in user retention through the onboarding funnel

- 35% increase in successful sign-ups for the platform

- Significant uplift in conversions for pay-as-you-go KYC offering

- Streamlined user journey enabling customers to initiate KYC checks within minutes

Business and Operational Benefits:

- Agile content workflow enabling marketing campaigns to respond quickly to regulatory demands

- Reduced developer dependency for content updates and informational page launches

- Enhanced brand positioning as trusted, regulation-compliant partner in KYC space

- Improved organic search rankings within first month post-launch

Compliance and Trust:

- Robust GDPR compliance reinforcing commitment to responsible data handling

- Accessible UI design expanding market reach and ensuring regulatory compliance

- Professional visual language building trust in sensitive financial services market

- Privacy-first design philosophy aligned with client’s compliance-focused business model